The agricultural industry is becoming increasingly unpredictable.

Climate change, market factors, and the high prices of operating a farm or ranch leave many landowners wondering whether they’ll be able to keep it all going.

Does this sound familiar?

Times are tough, but it’s hard to imagine selling the land you feel a deep connection to and hope to preserve for your heirs.

If you’re like many people in the industry, you’re looking for ways to cut costs and save money.

You’d probably like to take advantage of farming tax breaks wherever you can.

The good news is that you have options — including installing solar panels — that are great for the environment and your tax bill.

A conservation agreement provides additional benefits that can save you some serious money when tax time rolls around.

Don’t worry if you don’t know what this is.

Many farmers have never heard of it.

We’re here to tell you everything you need to know about the standards for conservation easements.

Get Conservation Tax Breaks for Farmers

You could gain a substantial tax break for protecting and conserving the land you already care for and about.

In fact, you may be able to deduct up to 100% of your income in any given year.

In bumper years, this could save you a lot of money when you file your taxes.

This is money that you could:

- Reinvest into the business or your family

- Put away for those leaner years

- Use to take that vacation you’ve been waiting for

There are, of course, steps you need to take to qualify for this incentive, and not every parcel of land is eligible.

What Are Conservation Easements?

Conservation easements offer agriculture landowners a way to protect their land while also giving you tax breaks.

These easements aim to preserve the land’s value as a natural or historical resource, with restrictions placed on development and use.

The parameters of an easement are established through a conservation agreement.

How Do You Get a Conservation Agreement?

To obtain an agreement, you must have land that qualifies and a land trust, government agency, or qualified easement holder that wants to enter into a contract.

The easement holder assesses your land for its conservation value and determines whether it meets the goals and requirements of the land trust or government agency.

Only formalized conservation agreements meet the guidelines for tax breaks for farmers.

You agree to donate the conservation value of your land to the easement holder, and the easement holder agrees to monitor the land and enforce restrictions established in the agreement.

What Happens If You Sell the Land or Pass It Along to Your Heirs?

The conservation agreement is part of the property deed.

If you sell the land or pass it along to your heirs, they are bound by the terms of the easement just as you were.

In some instances, a conservation easement is set up for a limited term, ending after a designated number of years.

In this instance, future owners would continue to be bound by the agreement until the term ends.

However, these types of conservation easements aren’t eligible for federal tax breaks for farmers and ranchers.

Do You Retain Any Ownership Rights?

You retain all landowner rights that do not interfere with the terms of the easement agreement.

A conservation easement splits ownership rights between you and the easement holder.

The land trust or government agency gains rights relevant to conservation and spelled out in the agreement.

You still own the land, and you continue to carry all responsibilities and liabilities of a landowner.

The easement holder is responsible for monitoring the land to ensure the agreement terms are met.

Can You Get Out of a Conservation Agreement?

In a word: no, you cannot get out of a conservation agreement.

This agreement is legally binding and lasts forever, at least if you want to take advantage of the tax breaks for farmers.

You also can’t alter the agreement unless you (or future owners) and the easement holder agree, which is only likely if the change leads to greater conservation value.

Understand the Standards for Conservation Easements

The standards for conservation easements can vary according to which agency or organization sets them.

The federal government establishes standards for landowners in general but includes additional standards for farmers and ranchers.

How Are Farmers and Ranchers Defined?

The definition of a farmer or rancher may vary depending on which type of tax breaks you’re looking at.

Federal tax incentives would apply to more agricultural businesses than other incentives, so understanding their definitions is a good place to start.

According to the federal government, farmers and ranchers:

- Receive at least 50% of their income from farming or ranching

- Harvest or raise any horticulture or agriculture commodity on a ranch or farm

- Cultivate the soil on a farm

- Handle storing, packaging, handling, drying, or grading any horticulture or agriculture commodity on a farm (caveat: the tenant, operator, or owner must produce at least half of the commodity)

- Plant, care, cultivate, cut, or prepare trees for market (milling is excluded)

If you meet any of these definitions, you could qualify for tax breaks for conserving your land.

What Types of Land Qualify for Conservation Easements?

Qualifying land must have a real conservation value, as determined by a qualified assessor.

If you want to qualify as a farm or ranch for federal purposes, your agreement must include terminology that requires the land to be available for agriculture.

This language obligates you and any future owner to continue to use the land for farming or ranching.

Farmland or ranchland that’s facing development pressure is often considered highly valuable for conservation.

Different counties and states also have their own conservation goals that establish what types of land qualify for conservation tax breaks.

Like the federal government, they may be interested in:

- Conserving agricultural land

- Protecting ecologically sensitive environments

- Providing education or recreation opportunities for the public

They may have other goals to protect wildlife habitat, preserve water quality, or increase forest cover.

The land trusts may also have their own requirements for what meets their standards for a conservation easement.

Can You Still Use the Land for Farming or Ranching?

Yes, most farmers and ranchers qualify for the easement because of the land’s farming and ranching value and continue to use it.

This type of easement falls under the open space use, qualifying it for tax breaks for farmers.

You and any future owners would continue your operations as long as they adhere to the agreements set up in the conservation easement.

The agreement could set parameters on farming practices that aim at soil or water conservation.

They may also limit uses in other ways to protect the land for future environmental health and farming or ranching practices.

You may have ecologically sensitive land, such as riparian land or wetlands.

This land could also be placed into a conservation easement, with guidelines established for land use options.

Find Out How the Conservation Tax Breaks for Farmers and Ranchers Work

Once you establish whether your land would qualify for a conservation easement, you’ll want to know how you benefit from giving up some of your landowner rights to protect the land you own.

Various counties offer tax incentives for conservation easements, and there are three other types of tax benefits that you and your heirs may qualify for: federal, state, and estate.

Each of these work differently from the others, but if you’re eligible for all the incentives, you’ll save significantly on your taxes.

How Does the Federal Tax Incentive Work?

In 2015, the federal government made conservation easement tax breaks for farmers and ranchers a permanent benefit.

To qualify, you must meet the government’s requirements, which include:

- The donation must be voluntary

- The land must fit the parameters set for conservation of open space, ecologically sensitive habitats, public education or recreation, or historically valuable land

- The agreement must clearly indicate that it is legally binding in perpetuity, regardless of who owns the land

- The land must be held in trust by a land trust, government agency, or qualified easement holder

- The agreement must set up restrictions for development on the land

If you have a conservation easement that meets these requirements, you can take federal tax breaks for farmers.

These breaks allow you to deduct up to 100% of your income on your federal taxes.

You can do so for the year that you enter into the agreement and any subsequent year for up to 15 years or until your total deductions equal the easement’s valuation amount, whichever comes first.

The benefit for farmers and ranchers is higher than other private property owners, who can only deduct up to 30% of their income for any given year.

The Internal Revenue Service does caution landowners to ensure they follow all guidelines and requirements to avoid penalties.

Are There Any State Tax Breaks for Farmers and Ranchers?

Depending on where you live, you may be able to take advantage of state tax incentives as well as federal tax breaks.

Qualifying for one does not necessarily mean you qualify for the other.

Sixteen states offer incentives for landowners who donate their land for a conservation easement.

Each state has its own set of standards, guidelines, and benefits.

These benefits can change frequently, so check with your tax attorney or your state’s internal revenue service to get up-to-date information on the current tax incentive structure.

Additionally, even if your state does not currently offer conservation easement tax breaks for farmers and ranchers, they may add them in the future.

Are There Estate Tax Incentives?

Like many business owners, you may want to leave your business as a legacy for your children and grandchildren.

When you work the land and work with it, it becomes a piece of who you are.

It holds a value that goes beyond dollars and cents.

Leaving it to your heirs is a powerful legacy, but inheritance comes with inherent tax liabilities.

Although a conservation easement is a permanently binding agreement that continues even after you’re gone, your heirs can take advantage of estate tax breaks for farmers.

When your heirs inherit the land, both estate and inheritance taxes are levied from the transaction.

Land that is held in a conservation agreement lowers how much they would pay in estate taxes in two ways:

- A conservation easement has a lower property value because it can’t be developed, which means that the taxes assessed on the parcel of land are also lower. If the value is low enough, then your heirs may not be required to pay any estate taxes on that land.

- Any land that is set aside under a conservation agreement is eligible for an exclusion. This means that your heirs would not have to pay estate taxes on 40% of the encumbered land’s value.

Your heirs would also be able to use any other state or federal conservation tax benefits the easement still qualifies for.

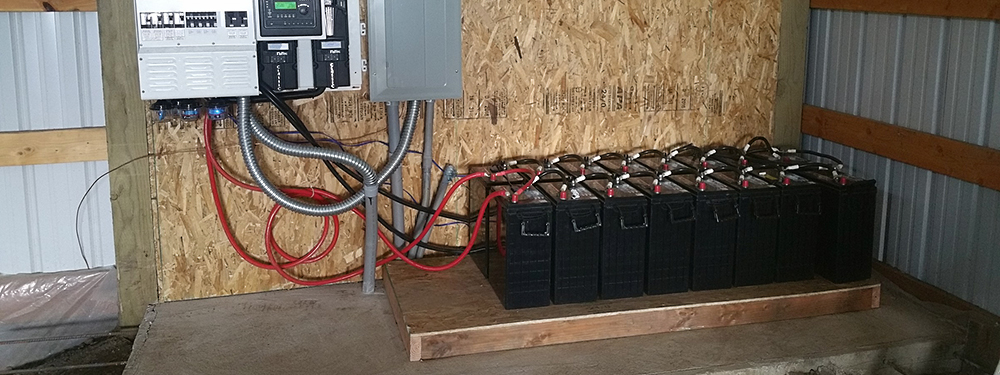

Get Additional Tax Breaks for Farmers by Installing Solar Panels

We at Unbound Solar want to help you explore all the ways you can save money while protecting your land for future generations.

Partnering with a land trust or government agency to create a conservation easement is a great option that benefits you, your family, and the planet.

Let us help you discover how solar can give you additional financial and environmental benefits.

Get in touch with us today – we’re happy to answer all your questions!