As a homebuilder, you possess great expertise that most people don’t.

And your years of hands-on experience have taught you the do’s and don’t’s building a house.

But what do you know about solar energy systems?

And, more specifically, solar financing?

You’re already incredibly busy.

This guide can help you advise your buyers by walking you through the most widely used ways to roll the cost of a new solar setup into a mortgage.

So you likely haven’t had much time to browse through the mounds of information out there.

Yet, the future of energy is solar.

If it’s not yet legally mandated in your area, there’s a good chance that it will be soon.

Ten states are currently mulling over solar mandates, including:

- Colorado

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Nevada

- New Mexico

- North Carolina

- Pennsylvania

- Texas

Meanwhile, 46% of homeowners surveyed have said they’re interested in going solar.

It appears that we’re reaching a tipping point with solar.

Therefore, a solid understanding of sourcing, installing, and financing photovoltaic systems is an excellent way to ensure that you and your company stay ahead of the curve.

As a builder, your homebuyers trust your expertise about all things related to their new home.

Accordingly, they’ll look to you to provide the information they need about setting up a solar system, complying with solar energy laws, and paying for a new solar array.

Benefits of Rolling Solar Financing Into a Mortgage

Over the past decade, it’s become more accessible for buyers to purchase a new solar system.

How’s this done?

Thankfully it’s as simple as rolling their solar system cost into their new home loan.

Combining the solar system costs into the mortgage means only one loan payment and one round of closing costs for your buyers.

With a mortgage, buyers are also likely to secure lower interest rates and better repayment terms than they could get with a separate solar loan.

Moreover, buyers qualify for a larger tax deduction:

Interest on mortgage payments is tax-deductible, while interest on solar loans or other personal financing methods is not deductible.

Rolling the cost of a solar system into the buyer’s mortgage also benefits you.

When a mortgage funds the system, you avoid the time-consuming, headache-inducing task of sorting out PACE loans, solar leases, and other administrative nightmares.

Combining Solar Financing with an FHA Mortgage

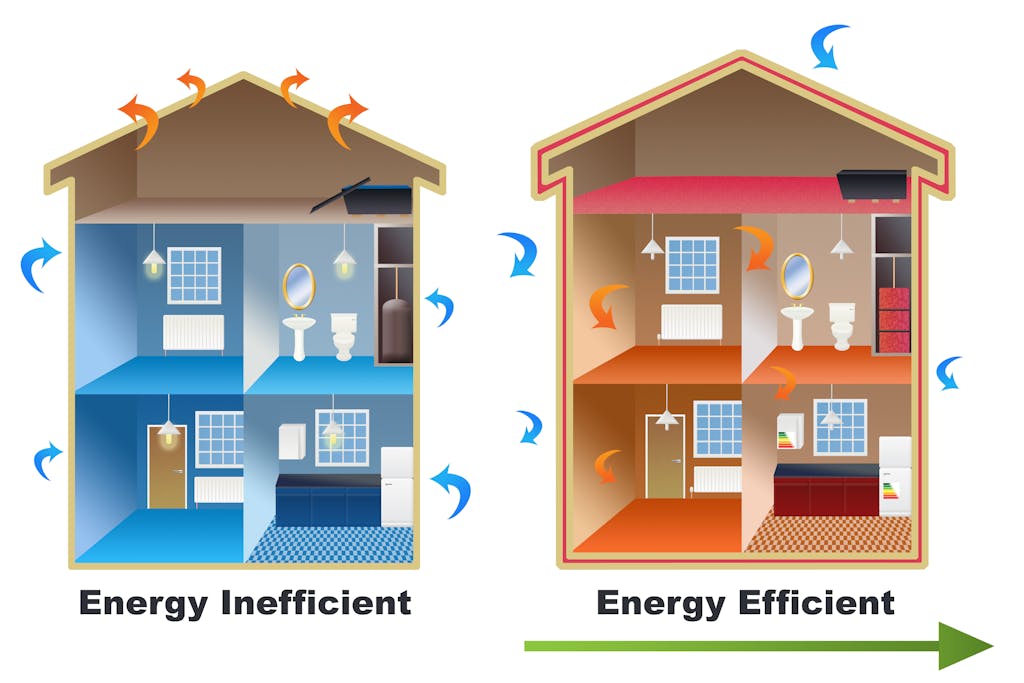

The Federal Housing Administration’s (FHA) Energy Efficient Mortgage (EEM) program was created to encourage and assist homebuyers in making their homes as energy-efficient as possible.

The program allows buyers to simultaneously finance the purchase of a home and the cost of upgrades or improvements in one loan.

Note that your buyer is only eligible so long as the improvements meet specific energy and cost-saving standards.

How It Works

The funds from an FHA-insured EEM loan can be used to buy a house and make qualifying improvements to the home’s energy efficiency.

The cost of improvements is added to the purchase price, and the buyer makes a single monthly loan payment.

In FHA terms, the energy upgrades that the buyer proposes to add to the loan are collectively called an “energy package.”

For a new solar setup, the energy package includes:

- The cost of all system components and other materials

- All design and installation costs

- Other related costs such as code inspections

The buyer can also include any costs incurred due to EEM regulations, such as the cost of obtaining a qualified home energy assessment and a Home Energy Rating System (HERS) report. More about these in a minute.

The Red Tape

Any solar financing rolled into an EEM must pass the FHA’s “cost-effective” test.

A solar system is cost-effective for existing homes if the amount of the estimated utility savings is more than the system’s cost over the system’s expected lifespan.

For a new construction project, the solar system must exceed the current HUD-adopted standards.

FHA rules require the buyer to have a qualified, HUD-approved assessor perform a home energy assessment to determine whether improvements pass the test.

The assessor will then prepare a HERS report.

It lists all the upgrades that could improve the home’s energy efficiency and the estimated energy savings for each recommended improvement.

To finance a solar system with an EEM, the HERS report must recommend the solar system.

The buyer can’t finance any items that exceed the estimated savings listed in the report or other FHA-mandated solar financing limits.

FHA’s Energy Efficient Home Policy

For an EEM to be approved, the buyer must meet a standard FHA loan’s minimum income, credit score, and debt-to-income ratio requirements.

One significant aspect of these loans is that the buyer only has to qualify for a loan amount that covers the purchase price of the home rather than the total loan amount with the solar upgrades.

To further sweeten the deal, when the new solar upgrades exceed specific efficiency standards, the FHA’s Energy Efficient Home policy lowers the minimum requirements for loan approval.

This makes it relatively easy for buyers to get approval for an EEM.

Solar and Wind Technologies (SWT) Policy

Just when you thought there couldn’t be more acronyms to throw in, hold onto your hats!

FHA guidelines include a complex set of limits on the total dollar amount of improvement costs that a buyer can roll into an EEM loan.

Fortunately, photovoltaic systems are exempt from those limits, thanks to the FHA’s SWT policy.

The SWT allows buyers to include all their solar improvement costs in the EEM, subject to a few requirements:

- The buyer must get an appraisal of the home’s value without the solar system

- The total amount of solar financing the buyer can roll into an EEM is limited to 20% of the appraised value

- For most EEMs, the buyer only needs to qualify for the purchase price portion of the loan before upgrades

However, when a buyer uses the SWT provisions to bypass the standard EEM loan limits, they must qualify for the total loan amount, including improvement costs.

Pros and Cons of an FHA EEM Loan

An FHA-insured EEM is often the best choice for a buyer with less regular income or credit or a hefty amount of other debt.

The program has more relaxed thresholds for credit scores and debt-to-income ratios and a minimum down payment as low as 3.5%.

Another significant benefit of the FHA programs is that the buyer only needs to qualify for the home purchase or refinance a portion of the mortgage without any solar financing thrown in.

This means a buyer can take out a larger mortgage loan than they would typically qualify for.

It would be good if the buyer were going to finance a new solar system either way.

An FHA mortgage is usually more affordable than a private loan.

While FHA EEMs offer wide accessibility and favorable financing terms, those benefits are tied to stringent restrictions and requirements that both you and your buyer will have to navigate throughout the build.

FHA loans also impose mandatory mortgage insurance premiums for the loan’s entire life, which diminishes the other program cost savings.

Funding Solar Upgrades through a VA Energy Efficient Mortgage

If your buyer has a military background or any connection to the military, they may qualify for an EEM through the Department of Veterans Affairs (VA).

The VA’s EEM Program is like the FHA’s but is limited to eligible military borrowers.

How It Works

With a VA EEM loan, buyers can combine the cost of allowable energy-efficient upgrades with a standard VA mortgage.

The primary requirement to include solar financing or other improvement costs in a VA mortgage is that the improvements must lower energy costs.

The Red Tape

The buyer’s job is to prove to the potential lender that the solar system or other upgrades meet the VA’s qualifying standards.

To do this, the buyer needs to get an official HERS report to show how much money the solar system will save in monthly utility costs.

The buyer also needs a detailed cost estimate from you showing how much the system will cost overall to purchase and install.

The lender then calculates how much this will increase the monthly mortgage payment.

Three criteria must be met to approve solar financing as part of the mortgage:

- Monthly utility savings must outweigh the increased monthly house payment

- The buyer must be able to afford the higher monthly payment, based on the VA’s standard mortgage eligibility criteria

- The solar system must increase the home’s value, and this increase must be more than the cost of the system

Pros and Cons of a VA EEM Loan

A buyer can use a VA-insured EEM to purchase a house or to refinance their existing home.

Unlike the FHA’s program, a VA EEM doesn’t impose limits on the loan amount, loan-to-value ratio, or the cost of improvements.

Buyers also get all the advantages of a standard VA-insured mortgage, such as low-interest rates, no mandatory mortgage insurance premiums, and no down payment requirement.

Of course, the VA’s military service requirements mean that many buyers won’t be eligible for this program.

The program is also limited to improvements on the buyer’s primary residence.

Financing a New Solar System with a Conventional Mortgage

There are many reasons a buyer might choose to combine their solar financing with a conventional mortgage.

This means a mortgage backed by Fannie Mae or Freddie Mac rather than an FHA or VA loan.

For example, suppose your buyer has an excellent credit score or can afford a sizable down payment. In that case, they may prefer a conventional loan over complying with a mountain of federal rules and requirements.

How It Works

The Federal National Mortgage Association (better known as Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) offer programs that allow buyers to finance solar systems and other upgrades as part of a mortgage loan.

The Fannie Mae option is the HomeStyle Energy Mortgage, while the Freddie Mac version is the GreenCHOICE Mortgage.

While the two programs are substantially identical, there are several key differences.

These involve the programs’ different standards to determine which buyers qualify for lower down payments.

The Red Tape

The HomeStyle Energy loan and the GreenCHOICE mortgage allow buyers to roll solar financing into purchasing or refinance a home.

There is a cap – 15% of the property’s value after the improvements are complete.

The down payment required for both loans can be as little as 3%, though the qualifying criteria for each loan are different.

Both require a minimum credit score of 620 and a maximum debt-to-income ratio of 45%.

The Pros and Cons of a Conventional Energy Efficient Mortgage

The main advantage of Freddie and Fannie’s programs is the substantial reduction in paperwork and administrative hoops to jump through compared to an FHA or VA loan.

The programs can combine with other conventional mortgage types to allow your buyers to bundle nearly any kind of improvements they wish into their mortgages, not just solar financing.

Most buyers qualify for extremely affordable down payments, and unlike FHA loans, there is no mandatory mortgage insurance for the life of the loan.

While conventional mortgages require monthly insurance premiums, those can be waived with a 20% down payment or canceled when the buyer reaches 20% equity in the home.

On the downside, buyers must qualify for the entire loan amount, including the cost of solar upgrades.

Not every buyer will have the excellent credit score and debt-to-income ratio required for a conventional loan.

Plus, buyers must qualify for the entire loan amount, not just the home price.

Help Your Buyers Navigate Their Options

By helping your buyers bundle their solar financing with their mortgages, you pave the way for a streamlined and hassle-free build.

Bundling also ensures you have funding available, and it saves your buyers some cash to boot.

Approval for many energy-centered mortgage programs depends on your buyer’s solar system components’ quality, life expectancy, and cost.

So, it’s critical to work with an experienced and trustworthy solar solutions provider throughout the process.

Contact Unbound Solar® to learn more about how we can help.